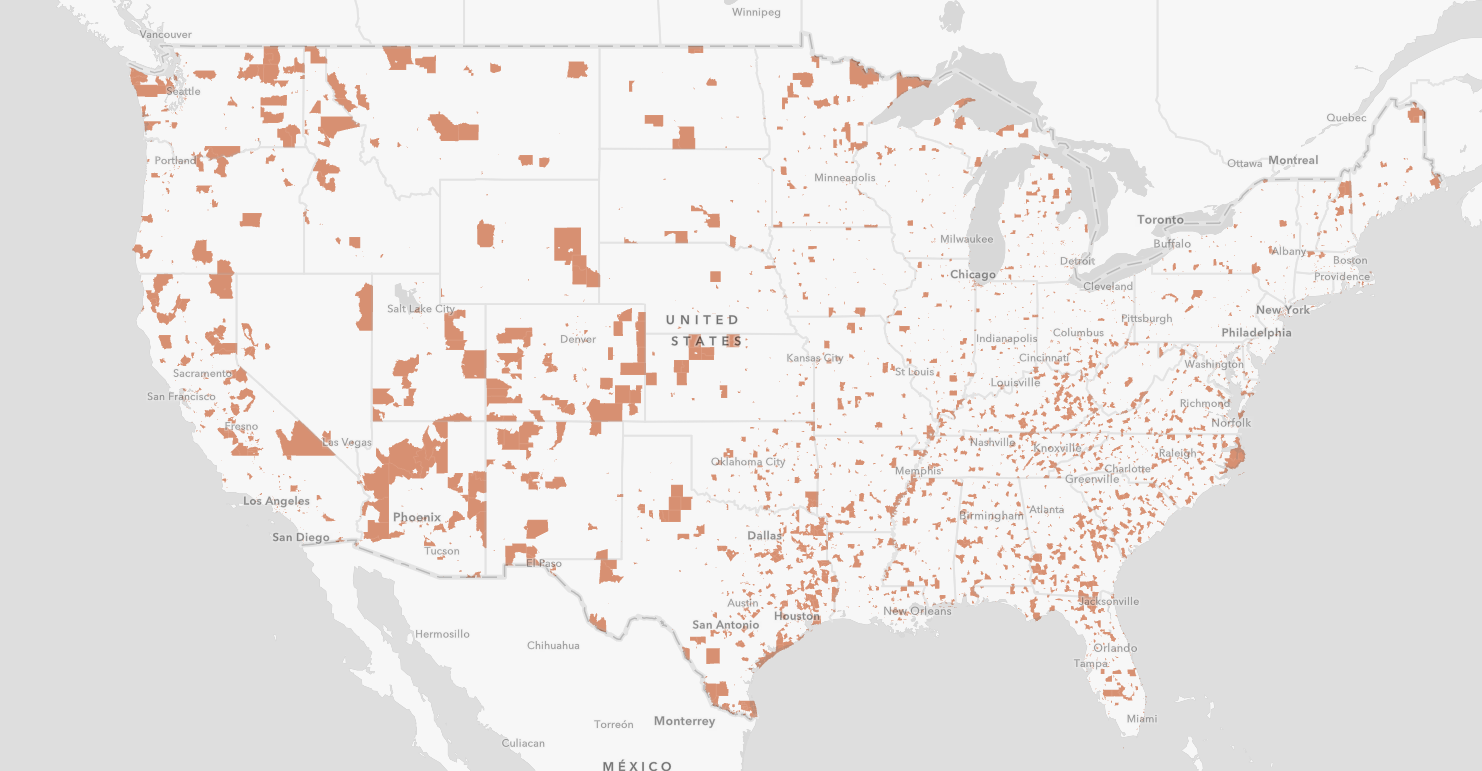

Overview

Opportunity Zones are a new community development program established by Congress in the Tax Cuts and Jobs Act of 2017 (H.R. 1 signed into law on December 22, 2017) to encourage long-term investments in low-income urban and rural communities nationwide. The Opportunity Zones program (Sec. 13823) provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing in Opportunity Zones.

The Opportunity Zones are low-income census tracks are areas where the poverty rate is 20 percent or greater and/or family income is less than 80% of the area's median income, and are designated by the chief executives of every U.S. state and territory.

Investments made by qualified entities known as Opportunity Funds into certified Opportunity Zones will receive three key federal tax incentives to encourage investment in low-income communities including:

-

Temporary tax deferral for capital gains reinvested in an Opportunity Fund

-

Step-up in basis for capital gains reinvested in an Opportunity Fund

-

Permanent exclusion from taxable income of long-term capital gains

For additional information on the treatment of capital gains invested and earned through the Opportunity Zones program, please see this summary published by the Economic Innovation Group based in Washington, D.C.

More Details: